American Express Business Loans Review (2025)

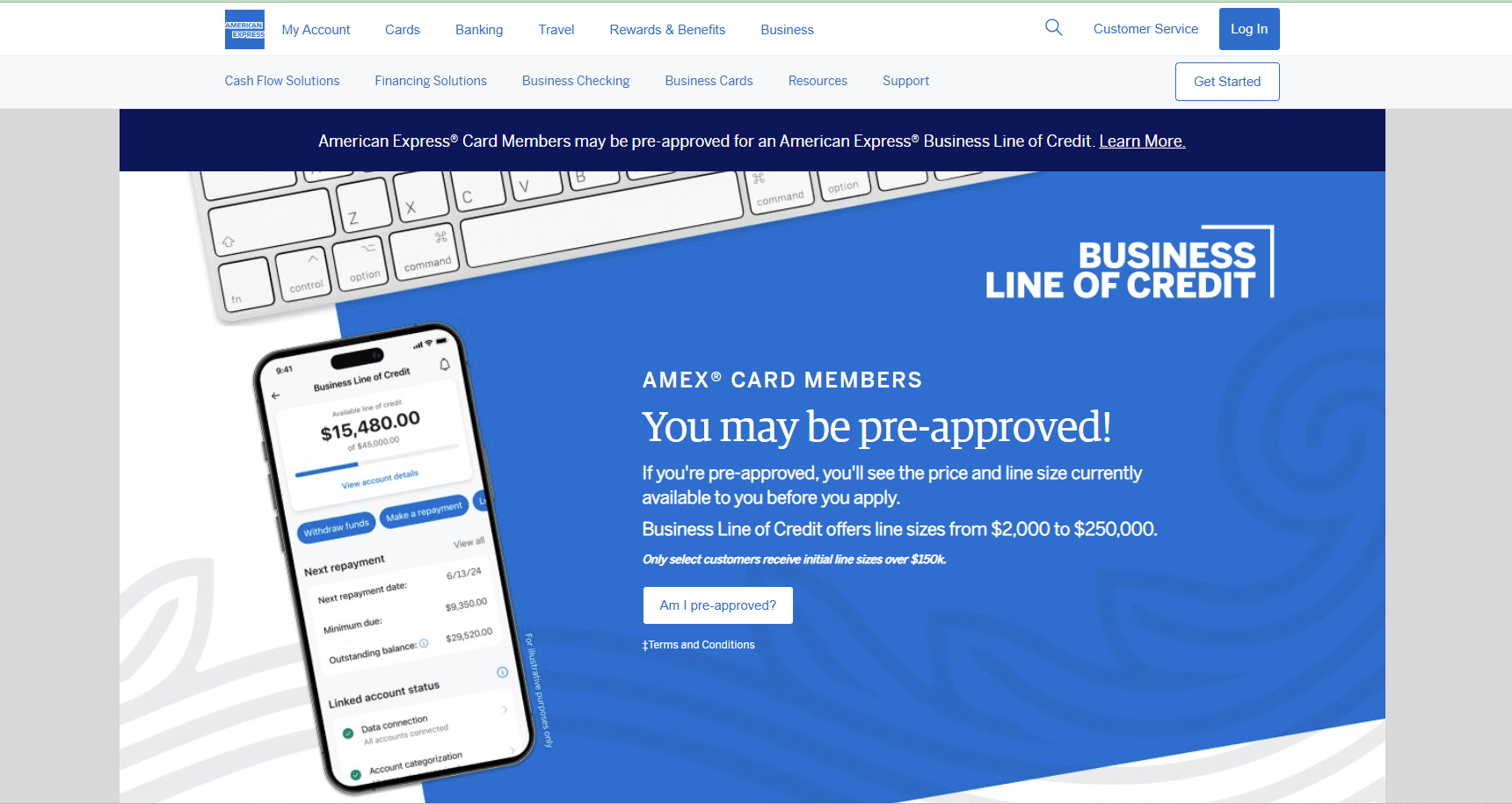

The American Express® Business Line of Credit provides businesses with flexible credit lines to help cover expenses. Once approved, borrowers can access funds as needed, drawing on their approved credit limit at any time. This revolving credit structure ensures businesses have the financial resources they require when they need them.

Key Features

- Loan Amounts: $2,000 - $250,000

- Interest Rates & Repayment Terms: 3-9% for 6-month loans, 6-18% for 12-month loans, 9-27% for 18-month loans, 12-18% for 24-month loans

- Fees: No origination, prepayment, or hidden fees

- Eligibility: Exclusively for eligible American Express cardholders

- Funding Speed: Funds disbursed within 3-5 business days of approval

Pros

- No Hidden Fees: Transparent pricing with no surprise charges.

- Quick Approval: Streamlined application process for cardholders, with pre-qualification that doesn’t impact credit scores.

- Trusted Brand: Backed by American Express’ strong reputation for customer service.

- Flexible Repayment Terms: Options ranging from 6 to 36 months to fit your cash flow.

- Early Payoff: No penalties for repaying the loan early.

Cons

- Limited Loan Amounts: Maximum of $75,000 may not suit larger businesses.

- Exclusivity: Only available to existing AmEx cardholders with pre-qualification.

- No Variable Interest Rates: Fixed rates only, with no flexibility for changing market conditions.

- Not Suitable for Startups: Requires an established relationship with American Express.

Who Is American Express Business Loan Best For?

American Express Business Loans are ideal for:

- Small business owners needing quick, predictable financing.

- AmEx cardholders with an established history who want a simple application process.

- Businesses seeking to cover smaller expenses like equipment purchases, marketing, or inventory replenishment.

How to Apply

- Check Eligibility: Log into your American Express account to see if you’re pre-qualified.

- Apply Online: Complete the simple application form.

- Review Terms: Choose your desired loan amount and repayment period.

- Get Funded: Once approved, funds are deposited into your bank account within 3-5 business days.

Bottom Line

American Express Business Loans are a trustworthy and convenient option for small businesses with moderate funding needs. While they lack the flexibility and higher loan limits offered by other lenders, their transparent terms, quick funding, and no-fee structure make them a competitive choice for eligible AmEx cardholders.

Physical Address

American Express® Business Line of Credit

925B Peachtree Street NE

Suite 1688

Atlanta, GA 30309

American Express National Bank Disclosure**

**All businesses are unique and are subject to approval and review.

American Express® Business Line of Credit offers two loan types, installment loans and single repayment loans for eligible borrowers. All loan term types, loan term lengths, and pricing are subject to eligibility requirements, application, and final approval. This [content / article] contains general information about the American Express® Business Line of Credit installment loan type only.

American Express® Business Line of Credit offers access to a commercial line of credit ranging from $2,000 to $250,000; however, you may be eligible for a larger line of credit based on our evaluation of your business. Each draw on the line of credit will result in either a separate installment loan or a single repayment loan. All loans are subject to credit approval and are secured by business assets. Every loan requires a personal guarantee. For single repayment loans, we charge a total loan fee that ranges from 0.95%-1.80% of the amount you borrow for 1-month loans, 1.90%-3.75% for 2-month loans, and 2.85%-6.05% for 3- month loans. Single repayment loans incur a loan fee at origination and the principal and total loan fee are due and payable at loan maturity. There are no required monthly repayments for a single repayment loan. Repaying a single repayment loan early will not reduce the loan fee we charge you. For installment loans, we charge a total loan fee that ranges from 3-9% of the amount you borrow for 6-month loans, 6-18% for 12-month loans, 9-27% for 18-month loans, and 12-18% for 24-month loans. Installment loans incur a portion of the total loan fee for each month you have an outstanding balance. If you repay the total of the principal of an installment loan early, you will not be required to pay loan fees that have not posted for subsequent months. For each loan that you take, you will see the applicable loan fee before you take the loan. Once you take the loan, the loan fees that apply to that loan do not change. We reserve the right to change the loan fees that we offer you for new loans at any time. American Express reserves the right to offer promotions to reduce or waive loan fees from time to time. Not all customers will be eligible for the lowest loan fee. Not all loan term lengths are available to all customers. Eligibility is based on creditworthiness and other factors. Not all industries are eligible for American Express® Business Line of Credit. Pricing and line of credit decisions are based on the overall financial profile of you and your business, including history with American Express and other financial institutions, credit history, and other factors. Lines of credit are subject to periodic review and may change or be suspended, accompanied with or without an account closure. Late fees may be assessed.

¹The required FICO score may be higher based on your relationship with American Express, credit history, and other factors.

Loans are issued by American Express National Bank.