LendingTree Business Loans Review

Finding the right business loan can be time-consuming, especially when comparing lenders individually. LendingTree simplifies the process by giving business owners access to multiple loan offers through a single application. By partnering with various lenders, the platform helps businesses find loans tailored to their needs—whether they have excellent credit or need financing with a lower credit score.

Loan Features

- Loan Amounts: $5,000 - $5,000,000

- Loan Types: SBA loans, term loans, business lines of credit, equipment financing, and more

- Interest Rates: Vary by lender

- Approval Time: As fast as 24 hours

- Credit Score Requirement: Flexible, with options for various credit profiles

Pros

- Access to multiple lenders with one application

- Loans available for various business needs, including working capital and expansion

- No impact on credit score for initial loan offers

- Competitive interest rates from multiple lenders

Cons

- LendingTree is a marketplace, not a direct lender

- Rates and terms vary based on the lender and borrower profile

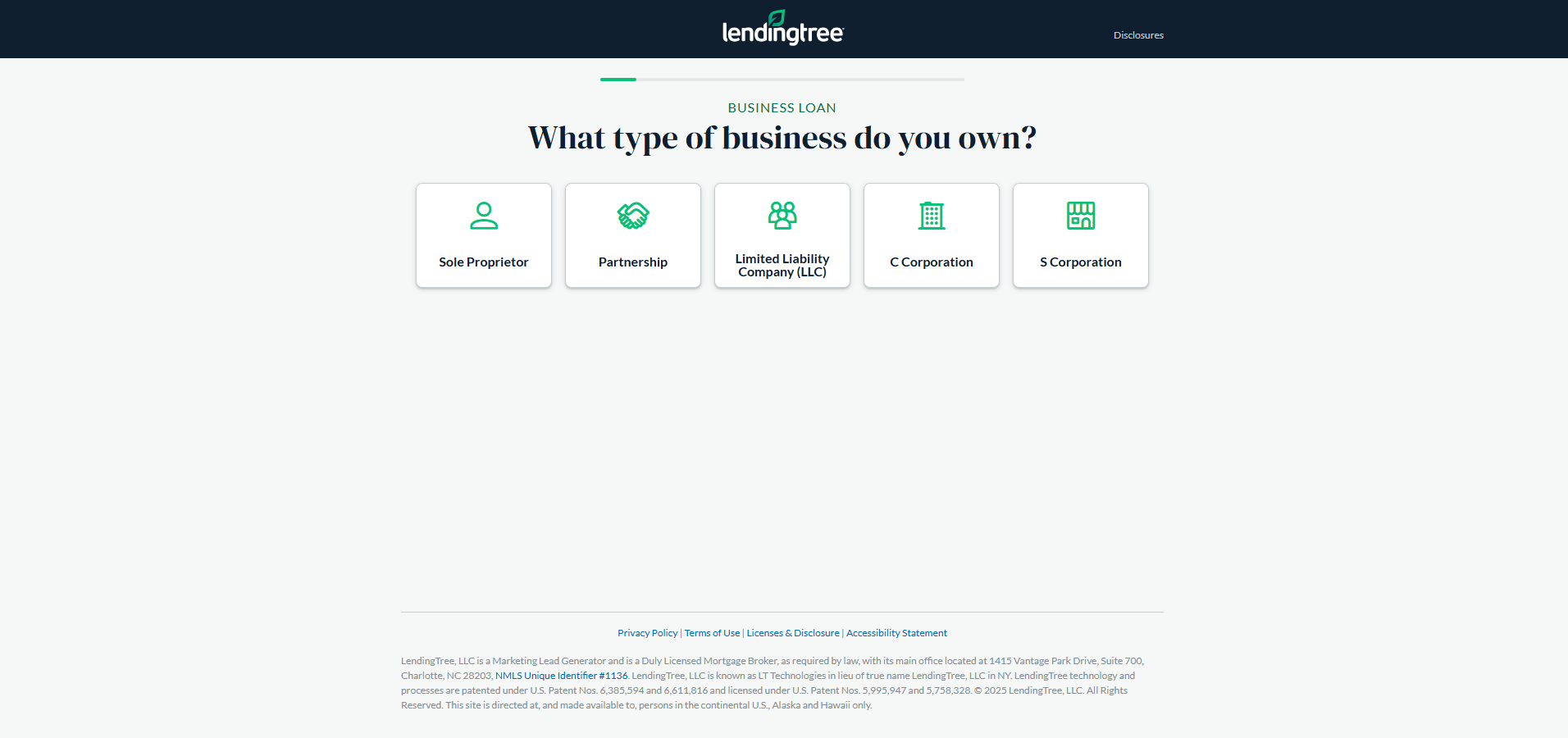

Application Process

LendingTree’s process is designed to make loan shopping easier:

- Online Application: Provide details about your business and financing needs.

- Loan Matching: LendingTree connects you with multiple lenders offering loan options.

- Compare Offers: Review different terms and rates before selecting the best one.

- Funding: Once approved, receive funding in as little as 24 hours, depending on the lender.

Who Is LendingTree Best For?

LendingTree is a great choice for business owners who:

- Want to compare multiple loan offers quickly

- Need financing options for different business needs

- Have varying credit scores and want lender flexibility

Bottom Line

LendingTree makes it easy for business owners to compare multiple loan options without applying separately to different lenders. By providing access to competitive offers with a simple application process, it’s a great tool for businesses looking to save time and find the best possible financing. However, since LendingTree is a marketplace, interest rates and terms will depend on the lender you choose.