Lendzi Review: A Flexible Option for Business Owners

Lendzi Business Loans Review

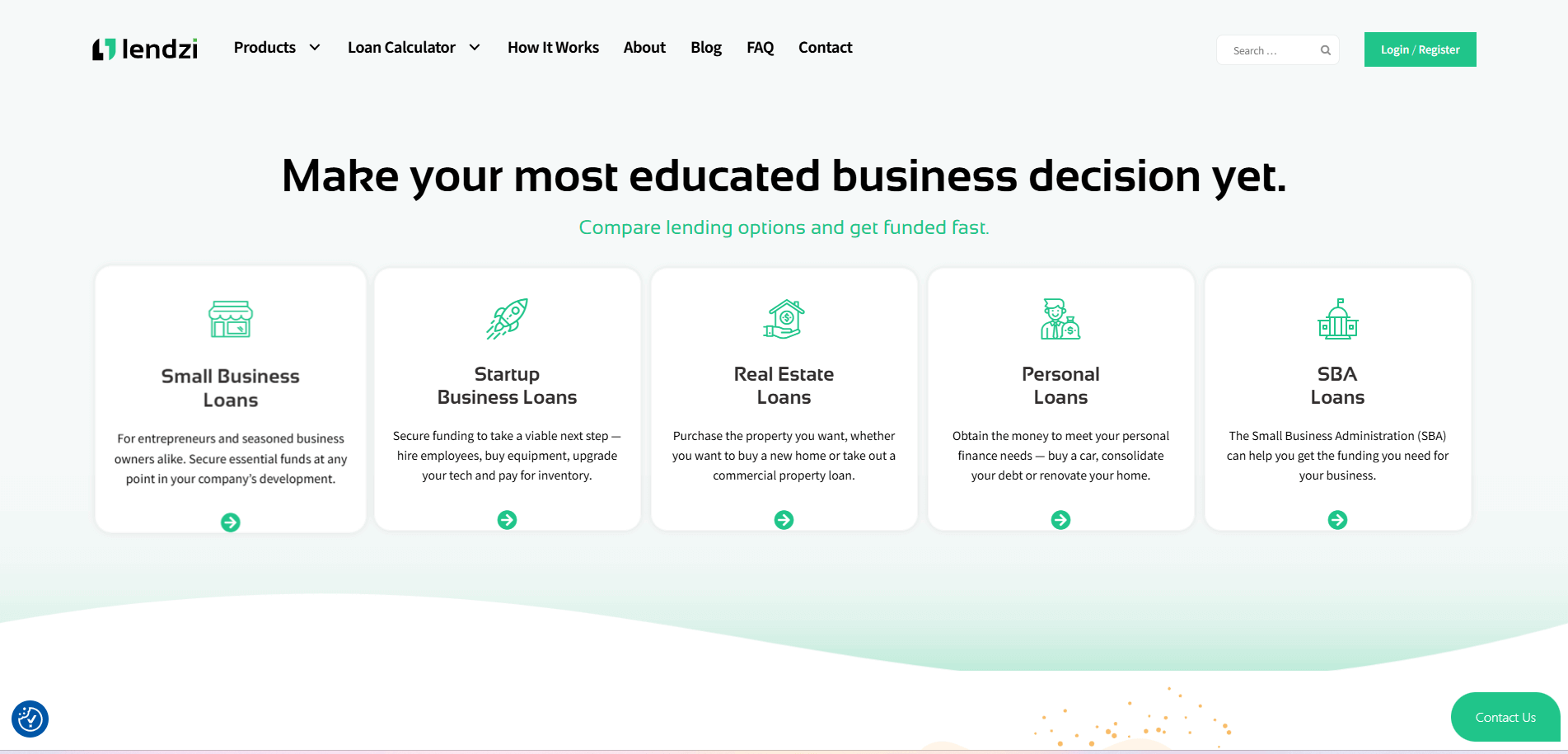

Finding the right business loan can be challenging, especially for businesses with bad credit or those seeking alternative lending options. Lendzi simplifies this process by matching business owners with lenders that suit their specific needs. With a fast online application and funding available in as little as 24 hours, Lendzi offers a convenient way to explore multiple financing options without the hassle of applying to multiple lenders individually.

Key Features

- Loan Amounts: $10,000 - $5,000,000

- Loan Types: SBA, term loans, equipment financing, lines of credit, and more

- Interest Rates: Vary by lender

- Approval Time: As fast as 24 hours

- Credit Score Requirement: Flexible (bad credit options available)

Pros

- Wide range of loan options, including SBA, term loans, and lines of credit

- Works with businesses of all credit types, including bad credit

- Quick online application process

- Personalized loan matching with expert guidance

Cons

- Interest rates and terms vary by lender

- Not a direct lender—acts as a marketplace

Who Is Lendzi Best For?

Lendzi is ideal for small business owners looking for a fast and flexible way to compare loan options. It’s particularly useful for:

- Startups and small businesses seeking alternative funding

- Businesses with less-than-perfect credit

- Entrepreneurs looking for quick funding solutions

Application Process

Lendzi offers a simple online application that connects borrowers with multiple lenders. The process includes:

- Pre-qualification: Fill out a quick online form with basic business details.

- Loan Matching: Lendzi pairs you with lenders that match your needs.

- Funding: Once approved, receive funding in as little as 24 hours, depending on the lender.

Bottom Line

Lendzi provides a convenient way to explore multiple business loan options through a single application. If you need funding but aren’t sure where to start, Lendzi’s lender network and personalized matching process make it a solid choice. However, since it’s a loan marketplace, terms and rates vary by lender, so be sure to compare offers carefully before making a decision.